Abstract

This TELIP requests approval and funding to run a 4-week TEL trading competition on a centralized exchange (CEX) using Cede Hub (a STORM Partners trading-competition partner). Cede Hub rewards users on-chain for off-chain actions (CEX trading) and has delivered 160+ campaigns with $600M+ in organic CEX volume.

Campaign proposal: Bybit, 4 weeks, $5,000 prize pool per week (fully distributed to traders/community) and Cede Hub fee of 0.5% of volume generated, capped at $5,000/week.

Budget requested: $40,000 (USDT or equivalent stablecoin): $20,000 prize pool + up to $20,000 in capped fees. Funds to be disbursed from the Treasury Council Safe with execution by the TAO.

Specification

Objectives

-

Increase TEL’s CEX trading activity

-

Attract new holders and re-engage existing traders by aligning incentives with real trading behavior.

-

Strengthen investor optics and negotiations with exchanges

-

Amplify upcoming announcements with coordinated, measurable impact.

Partner & Approach

-

Partner: Cede Hub (via STORM Partners). Proven track record with 160+ campaigns / $600M+ organic CEX volume.

-

Mechanics: Cede Hub runs trading competitions on app.cedehub.io. Users trade TEL on the designated CEX spot pair; rewards are paid on-chain based on verified off-chain trading activity.

Proposed Campaign (selected by STORM)

-

CEX: Bybit

-

Duration: 4 weeks

-

Prize Pool: $5,000/week, fully distributed to traders and TEL community participants via Cede Hub (total $20,000).

-

Expected Weekly Organic Volume: $1,000,000–$2,000,000*

-

Cede Hub Fee: 0.5% of generated volume, billable volume is capped at $1,000,000/week → $5,000/week max (total $20,000).

-

Total Budget: $40,000 (USDT or equivalent stables

* Volume generated with the campaign depends on the liquidity, as only takers orders are allowed during the competition. It means that with tight spread (lower than 0.3%) and enough liquidity close to the spot price (at least $1,000 to $1,500 in the top-of-book liquidity on both sides, which typically reflects a -0.2% to -0.4% depth) the project can expect to be on the higher end of the estimated volume margin.

Cede Hub always aligns liquidity aspects with the project’s market maker directly, to ensure optimal setup for the campaign

Reward Design (Cede Hub standard, tuned for TEL)

The rewards are distributed to all traders participating in the campaign, based on their volume generated.

Higher volume generated means more rewards to the trader.

Volume that a single trader can generate during the campaign is capped, to prevent a few select traders generating all the volume and getting all rewards. This way Cede Hub ensures that more people can participate in the campaign and win rewards, improving the project’s exposure to a variety of retail traders.

All rewards are distributed fully automatically by a smart contract on Arbitrum network

Data, Reporting, and Tooling

During the campaign, the project will have access to a live campaign dashboard.The dashboard allows to track key campaign KPIs in real time.

KPIs include:

-

Total organic volume generated

-

Total prize pool spent

-

Daily breakdown of organic volume generated

-

Average volume per trader

-

Median volume per trader

-

Median of all trades

-

Volume:reward ratio

-

Volume chart

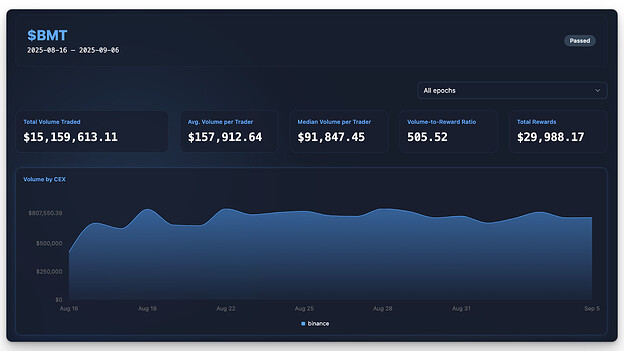

Example of campaign dashboard:

Budget & Payments

| Item | Amount | Notes |

|---|---|---|

| Prize Pool | $20,000 | $5,000/week x 4 weeks |

| Cede Hub Fees | Up to $20,000 | 0.5% of volume generated, capped at $5,000//week |

| Total | $40,000 | Stablecoin (USDT or equivalent) |

-

Source of Funds: Treasury Council Safe

-

Executor: TAO to manage payouts and STORM to manage partner coordination.

-

Payment Terms: the campaign is paid fully upfront: prize pool has to be transferred to a smart contract on Arbitrum network (USDT on Arbitrum), service fee can be transferred on EVM compatible chains prior to campaign launch

Rationale

Why Cede Hub?

-

Proven delivery at scale: 160+ campaigns; $600M+ organic CEX volume across top venues.

-

Case studies indicate durable lift:

-

Agridex (Gate / MEXC): $76k rewards → $34.9M organic volume (≈460× ratio) across 5 months, with average daily volume ≈**$249k**, and post-campaign stability ≈**$500k/day**.

-

Perpetual Protocol (Binance): $28.8k rewards → $21.2M organic volume (≈737×), average $758k/day; sustained $600k–$1.5M/day one month post-campaign.

-

Bubblemaps (Binance): $7k rewards → $3.46M organic volume (≈495×) in 1 week; renewed for 4 weeks.

-

SEDA (MEXC): $20k rewards → $13.27M organic volume (≈663×); average $473k/day during campaign and immediate extension to 8 more weeks due to results.

-

-

On-chain payouts for off-chain actions provide transparency and community trust while avoiding exchange custody of prize funds.

-

Listing & delisting dynamics: Competitions help hit listing KPIs and maintain healthy fully organic trading volume, while attracting new holders and amplifying announcements.

Why Now?

- TEL liquidity and discoverability on CEXs are pivotal for onboarding new users to the Telcoin ecosystem. Coordinated, time-boxed activation aligned with communications creates measurable, compounding visibility.

Implementation Steps

-

Approval & Budgeting (Week 0): Approve this TELIP and authorize $40,000 from the Treasury Council Safe; authorize TAO to execute and convert to stablecoins as needed.

-

Partner SOW & T&Cs (Week 0–1): Finalize scope, anti-abuse parameters, eligibility, reporting cadence, and payment schedule.

-

CEX Coordination (Week 1): Confirm pair(s), API/verification flows, and calendar windows to avoid maintenance/blackouts.

-

Creative & Comms (Week 1): Prepare campaign page, rules, assets, and coordinated announcements (no price-promotional language).

-

Launch (Week 2): Competition live for 4 weeks with live leaderboard and status reports.

-

Close & Settle (≤10 biz days post): Final rewards distribution on-chain; final invoice (respecting weekly caps); deliver post-mortem and go/no-go for extension.

KPIs & Evaluation - Cedehub probably has standard behaviours here

-

Primary: Qualified organic retail trading volume per week (target $1M–$2M), unique qualified traders, volume/reward ratio.

-

Secondary: Day-7/Day-30 trader retention on the pair, average daily volume increase vs. 30-day pre-baseline, daily frequency of trading (Bybit KPI)

-

Success Thresholds (guidance): ≥$1M/week qualified volume and ≥200× volume/reward ratio

Risk Management

-

Wash trading / sybil?

-

All campaigns on Cede Hub only allow takers orders. It means that traders can not place limit orders during the competition. This prevents self trading behavior and ensures that all volume generated with the campaign is organic retail trading volume

-

Cede Hub implements sybil protection, meaning that there’s always a single KYC CEX account corresponding to a campaign participant

-

During the campaign all users use their personal CEX accounts.

-

-

Regulatory/ToS?

- Cede Hub trading competitions are compliant and welcomed by all CEX, as they only bring organic retail trading volume.

-

Reputation? - potential effect on TEL optics?

-

Operational -

-

All operations related to the campaign are fully handled by Cede Hub, including but not limited to:

-

Campaign page setup and ruleset configuration

-

Liquidity monitoring and alignment with the market maker

-

Campaign performance monitoring and ruleset adjustments based on KPIs

-

Community management and feedback collection

-

Reward distribution

-

Ensuring fair participation between traders

-

Reporting and data analytics

-

-

Requested Action

-

Approve a budget of $40,000 from the Treasury Council Safe for a 4-week TEL trading competition on Bybit delivered by Cede Hub with on-chain rewards.

-

Authorize TAO to execute partner agreements, manage payments (stablecoins), coordinate comms, and deliver reporting to the Councils.